Solutions

Case Studies

Case studies highlight local business and initiatives who are making strides in building a better tomorrow

Our 21st century financial system requires individuals to have a foundational understanding of how to navigate its formal mechanisms, from trusting and using banking services such as savings accounts, to managing personal credit. However, the system also relies on communities’ ability to access capital for personal and commercial purposes. Knowledge of and access to savings and wealth generation vehicles are important for creating an ecosystem where community members and entrepreneurs of any background can attain financial stability, and ultimately create cycles of financial prosperity.

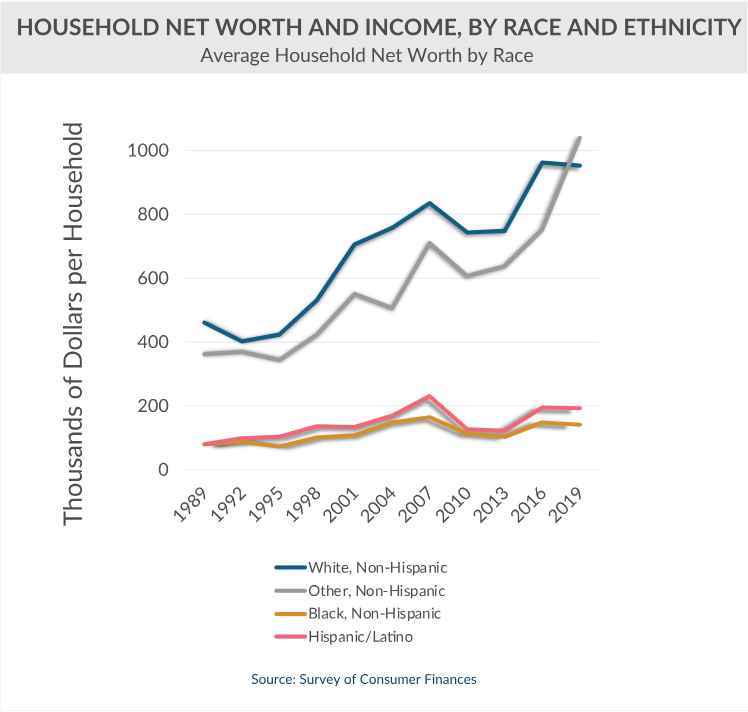

Today, Black, Hispanic, and low-income communities disproportionately lack access to capital, which is key for building generational wealth. Nationally, white families hold eight times and five times more wealth, respectively, than Black and Hispanic families.118 Even among families with college degrees, white families hold 5.5 times and 3.5 times more wealth, respectively, than Black and Hispanic families. When it comes to securing home mortgage financing, borrowers of color face the greatest obstacles to buying a home. Black and Hispanic borrowers are denied mortgages at rates of 27.1% and 21.9%, respectively, compared to 13.6% for white borrowers.119 Furthermore, Black and Hispanic borrowers experience far higher denial rates across a wide range of loan types, including home purchase, home improvement, and refinancing. This inequity in obtaining financing for personal purposes has serious negative long-term consequences for individuals and families and hinders the building of generational wealth.

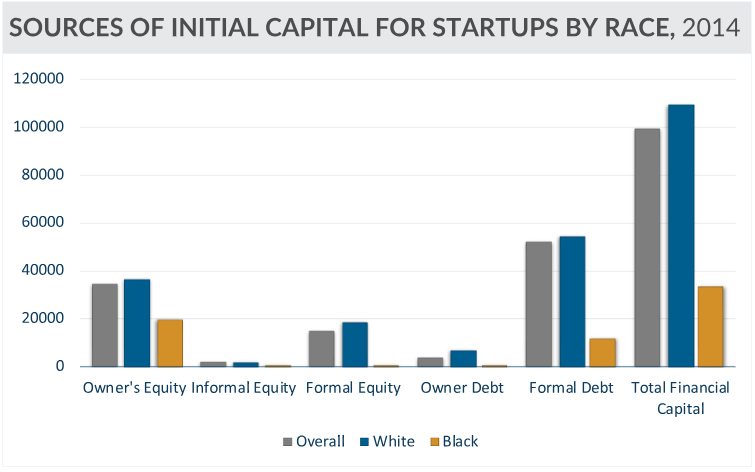

Inequities in borrowing extend beyond personal capital and into commercial financing. For business owners from historically underserved communities, unequal access to capital is pervasive, impacting small businesses seeking working capital and high-growth startups pitching for venture funding. According to the Federal Reserve, Black and Hispanic- owned businesses received their entire financing request in only 14% and 19% of cases, respectively, compared to

34% for white-owned businesses.120 Furthermore, as of 2020, oCapital Region has experiencednly 1% of venture capital-backed founders were Black and fewer than 2% were Hispanic.121 These discrepancies were exacerbated by the economic turmoil of the COVID-19 pandemic, as businesses run by individuals of color were more negatively impacted by the economic downturn and continue to face greater financial instability than businesses run by white entrepreneurs.122 The result of these financing inequities is a diminished ability for entrepreneurs of color to own and operate enterprises that can generate wealth for their families and communities.

Closing the equity gap requires education for all levels of understanding, from how credit and the banking system work, to making basic investment decisions, to launching companies as a means to long-term wealth generation. It is imperative that society supports underserved communities to better understand wealth-generating mechanisms, while also helping to make these mechanisms more equitable for everyone.

The following solutions explore ideas for fostering a more inclusive and productive environment for individuals, households, small business owners, and startup founders to equitably access financial education and capital. The goal of these recommendations is to help make the Capital Region a place where communities that have historically experienced challenges accessing economic opportunities, can achieve long-term financial prosperity.

JPMorgan Chase - https://www.jpmorganchase.com/news-stories/jpmc-commits-350m-to-grow-black-latinx-women-owned-sb

JPMorgan Chase - https://www.jpmorganchase.com/news-stories/jpmc-commits-350m-to-grow-black-latinx-women-owned-sb

Upsurge Baltimore - https://upsurgebaltimore.com/

Upsurge Baltimore - https://upsurgebaltimore.com/

Case Study:JPMorgan Chase

JPMorgan Chase Commits $350M to Grow Black, Latin, and Women-owned Small Businesses

In February 2021, JPMorgan Chase & Co. (JPMC) committed $350M to grow underserved small businesses as part of its $30B commitment to expand economic opportunity in underserved communities by harnessing its business, policy, data, and philanthropic expertise.

JPMC’s commitment seeks to reduce capital access barriers and economically empower underserved communities of color through:

Low-Cost Loans and Equity Investments

More than 40% of the commitment will be low-cost loans and equity investments, including a $42.5M investment to expand the Entrepreneurs of Color Fund, in conjunction with the Local Initiatives Support Corporation (LISC) and a network of CDFIs

Policy Solutions

Releasing data-driven policy solutions through JPMC’s PolicyCenter to improve SBA programs, including Community Advantage and Small Business Investment Company (SBIC) programs

Philanthropy

Building capacity for diverse-led nonprofits, including the signature Ascend program, to provide underserved entrepreneurs with business education, consulting services, and partnerships with regional and statewide corporate partners

Case Study:Upsurge Baltimore

UpSurge Baltimore is a nonprofit accelerator focused on making Baltimore the country’s first EquitechV city and a place where founders from all backgrounds, sectors, and stages can successfully launch an enterprise. It is also an investment engine that partners with organizations to make Baltimore a global platform for attracting knowledge-economy companies, quality jobs, and pathways to prosperity.

UpSurge Baltimore executes its mission by:

- Anchoring in a singular Equitech ecosystem vision: UpSurge aligns voices from across Baltimore’s entrepreneurship ecosystem on a common vision

- Focusing on Baltimore founders and companies: UpSurge supports locally based founders in overcoming their obstacles, and fostering a local network of partners, peers, mentors, and customers

- Attracting companies, capital, and talent: UpSurge engages in direct outreach to companies and investors; supporting joint accelerators to attract high-potential startups to Baltimore

The organization works with an ecosystem of cross-sector partners, including Partnership organizations such as Johns Hopkins University and T. Rowe Price.

Website Development By Top Shelf Design

Website Development By Top Shelf Design