Solutions

Case Studies

Case studies highlight local business and initiatives who are making strides in building a better tomorrow

The Capital Region has experienced tremendous economic growth over the past decade. However, this growth in housing demand has outpaced supply and wages, creating an affordability crisis.176 The lack of affordable and attainable housing threatens regional economic competitiveness and vitality as fewer residents are able to maintain healthy, stable housing in the region.

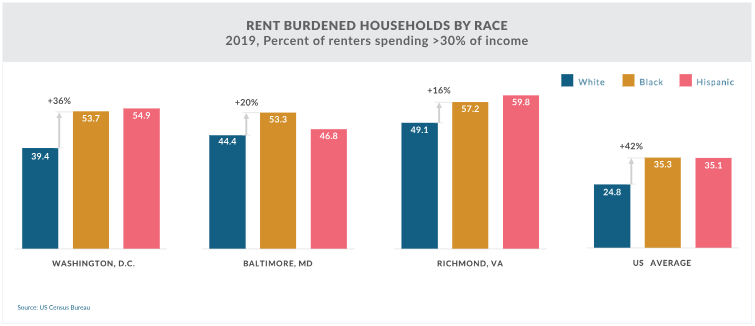

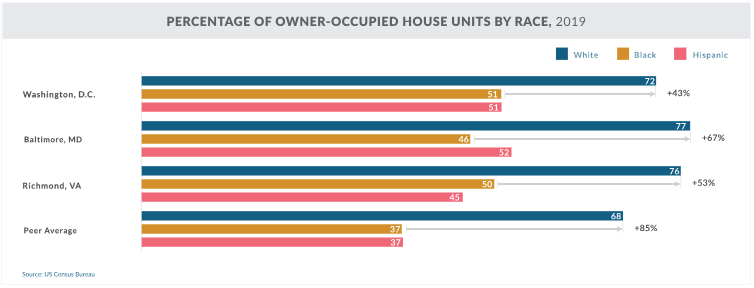

Rising housing cost burdens have hit Black residents especially hard—as of 2017, there was a 17.9% Black-white gap in the percent of households that are rent burdened in the Capital Region—a figure that has likely only been exacerbated by the pandemic and rising rent prices.177 In 2021, rent prices rose 11% nationwide—in some parts of the Capital Region, rents rose nearly 22%.178 The numbers are not any better when it comes to homeownership: the gap in Black-white homeownership in the Capital Region is 25.2%, and is most severe in Baltimore at 30.9%.177 For those that do own homes, Black and Hispanic-owned median home values are typically lower than white-owned home values. One study found that owner-occupied homes in majority Black neighborhoods are undervalued by $48,000 on average per home, amounting to cumulative losses of $165B for Black homeowners across the country.179 These disparities exacerbate the racial equity gap and prevent our region from reaching its full economic potential.

There are severe economic impacts from the affordable housing crisis: nationwide, research shows that the affordable housing crisis costs the U.S. economy nearly $2 trillion per year in lost wages and productivity.180 Severe housing cost burdens do not only affect residents—they affect businesses and the community, too. Many renters and owners are finding themselves repeatedly displaced, and many are no longer able to afford to choose where they live. Housing prices are growing in each major city within the Capital Region—Richmond has experienced the highest 5-year change in median home price at 50.4%, followed by Baltimore at 34%, and Washington, D.C. at 22.8%. All three cities’ median income growth has lagged behind home prices in this timeframe.181 Without sufficient wage growth and an adequate of supply of housing, new talent is less likely to come to the region, and the existing workforce is less likely to stay. One study found that the second most-commonly cited reason for leaving the District (behind job change) is for “new or better housing,” and the third most-commonly cited is for “other housing reason.”182

Defining

Affordable Housing: The U.S. Department of Housing and Urban Development

defines affordable housing as housing in which the occupant is paying no more than

30% of their income for housing costs.

Anyone paying more than 30% of their income on housing is considered housing-cost burdened183

The public, private, and nonprofit sectors must work together to address the housing crisis across the region. Large-scale financial investment and public policy change is required to meet our region’s housing needs and promote an inclusive economy where all community members can thrive.

JBG SMITH Impact Pool - https://www.jbgsmith.com/about/washington-housing-initiative/impact-pool

JBG SMITH Impact Pool - https://www.jbgsmith.com/about/washington-housing-initiative/impact-pool

Live Near Your Work Baltimore - https://livebaltimore.com/live-near-your-work/

Live Near Your Work Baltimore - https://livebaltimore.com/live-near-your-work/

Case Study:JBG SMITH Impact Pool

Launched in 2018 by JBG SMITH and the Federal City Council, the Washington Housing Initiative (WHI) is a

transformational, market-driven approach to preserve and create affordable workforce housing throughout

the DC metro region. Through its two primary vehicles – the Washington Housing Conservancy and the

Impact Pool – WHI seeks to ensure that essential workers like teachers, nurses, first responders, and

their families have access to high-quality housing in amenity-rich neighborhoods near great schools,

public transportation, and job opportunities.

The Washington Housing Conservancy (WHC) is an independent 501(c)3 whose mission is to preserve

affordable housing, avoid displacement, and promote economic mobility, particularly for moderate- to

low-income residents of color.

The Impact Pool is a private investment vehicle that provides the financing that enables the preservation

of affordable multifamily housing in the DC metro region for local workers who are the lifeblood of their

communities. The Impact Pool adheres to the following key principles:

- Focus on high-impact locations

- Commit to long-term affordability

- Invest at scale with speed, certainty, & flexibility

- Sustain and strengthen inclusive communities

- Build a replicable model that can be used by other communities

In 2020, the Impact Pool completed its first round of fundraising, with almost $115 million in investor

commitments secured, primarily from financial institutions, foundations, and local businesses. To date,

the Impact Pool has deployed over $66 million and preserved 1,750 units. Several regional corporations

invest in the Impact Pool, including Partnership organizations: Bank of America, JPMorgan Chase & Co

and Wells Fargo. The Impact Pool is managed by JBG SMITH Impact Manager, a subsidiary of JBG SMITH

Properties.

Case Study:Live Near Your Work Baltimore

Live Near Your Work is a partnership between

the City of Baltimore

and over 100 local

employers that provides

funds to employees to

use toward a down

payment or closing costs

for homes in designated

Baltimore neighborhoods.

Depending on the employer, incentives range from $2,000 to $18,500 and are funded partially by employers

and partially by the city government. The goal of the program is to help employees secure stable housing

near their work and live in Baltimore long-term.

Some employers also provide homebuying courses and 1:1 pre-purchase counseling to further assist with the

process. Several Greater Washington Partnership partner organizations participate in the program,

including The Annie E. Casey Foundation, Exelon, Harbor Bank of Maryland, Johns Hopkins University, and

Under Armour.

Website Development By Top Shelf Design

Website Development By Top Shelf Design